Your NDIS Budget

It's a bit of a beast and really hard to understand and get your head around.

To help you here are a few topics you might be interested in.. we keep on building them as we write more so you can find stuff.

Topics you will find here are:

To help you here are a few topics you might be interested in.. we keep on building them as we write more so you can find stuff.

Topics you will find here are:

- Your NDIS Budget support categories

- Reading and understanding your NDIA Budget

Your NDIS Budget support categories

Core Supports is not one category but in fact four categories.

It consists of:

1. Assistance with Daily Life (Includes SIL) – this is mostly used for supports at home such as personal care, domestic help, respite, etc. However, it can also be used for nursing care or therapies as a temporary measure for people with certain disability related health conditions.

2. Transport – this is to help with your transport needs and most of the time, it’s paid directly to your bank account every fortnight. If you see a dollar amount on your plan for transport but never received any money, make sure you’ve given NDIA your bank account details. You can do that in the myplace portal or ring the call centre.

3. Consumables – this is mostly for continence products, low-cost equipment or interpreters.

4. Assistance with Social, Economic and Community Participation – this is to support you to do stuff in the community, participate in recreational activities, or get help with employment.

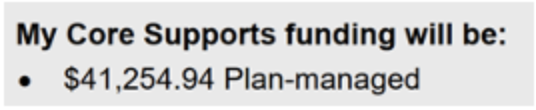

When you get a new plan, if your Core Supports is plan-managed, your plan manager would probably have spoken to you about how much to put in each of the categories (except transport as that’s usually self-managed). This is because when we make service bookings (see last month’s newsletter for information on service bookings), we have to book one category at a time and allocate a dollar amount to each category.

This is why the budget reports you get from us every month looks a bit different to the budget report in your portal (see last month’s newsletter on how to read budget reports).

It consists of:

1. Assistance with Daily Life (Includes SIL) – this is mostly used for supports at home such as personal care, domestic help, respite, etc. However, it can also be used for nursing care or therapies as a temporary measure for people with certain disability related health conditions.

2. Transport – this is to help with your transport needs and most of the time, it’s paid directly to your bank account every fortnight. If you see a dollar amount on your plan for transport but never received any money, make sure you’ve given NDIA your bank account details. You can do that in the myplace portal or ring the call centre.

3. Consumables – this is mostly for continence products, low-cost equipment or interpreters.

4. Assistance with Social, Economic and Community Participation – this is to support you to do stuff in the community, participate in recreational activities, or get help with employment.

When you get a new plan, if your Core Supports is plan-managed, your plan manager would probably have spoken to you about how much to put in each of the categories (except transport as that’s usually self-managed). This is because when we make service bookings (see last month’s newsletter for information on service bookings), we have to book one category at a time and allocate a dollar amount to each category.

This is why the budget reports you get from us every month looks a bit different to the budget report in your portal (see last month’s newsletter on how to read budget reports).

Instead of a single category called Core Supports as you can see in this example from the NDIS portal:

Core Supports is very useful because it’s so flexible compared to the other 11 categories. To start with, the dollars in Core Supports are completely flexible between the categories we book.

So for example, if you’ve spent more on doing stuff in the community than initially anticipated, we can amend the booking by moving some money from Assistance with Daily Life to Assistance with Social, Economic and Community Participation. However, this does mean that you will have less to spend on support at home. The bottom line is that you can’t spend more than what you get funded for.

The next lot of categories are called Capital Supports and it consists of:

5. Assistive Technology – used for purchase and maintenance of equipment

6. Home Modifications and Specialised Disability Accommodation (SDA) – this is mostly used to make your home more accessible. It also includes accommodation for people with high support needs.

The rest of the categories are called Capacity Building (CB) Supports. Why nine instead of one beats me.

They are:

7. Support Coordination – this allows a Support Coordinator to work with you to implement your plan and achieve your goals.

8. Improved Living Arrangements – this is funding specifically to help you to find somewhere appropriate to live or keep the place you’re living in.

9. Increased Social and Community Participation – this is about learning new skills to be more independent including having a mentor or using peer support.

10. Finding and Keeping a Job – this is specifically about employment. It can be used to get career counselling or get help from an employment agency. This is an important category to have for young people leaving school.

11. Improved Relationships – this is specifically about behaviour supports.

12. Improved Health and Wellbeing – this funds support from a dietician or exercise physiology.

13. Improved Learning – this is also for school leavers but it’s for help with transitioning to further education.

14. Improved Life Choices – it’s also called CB Choices & Control. This is the category to have if you would like any part of your plan to be plan-managed. It’s specifically for plan management.

15. Improved Daily Living Skills – it’s also called CB Daily Living or CB Daily Activity. This includes more supports than any other capacity building categories. This is my second favourite category after Core Supports. It covers early childhood intervention, skill development, nursing care and all the allied health supports such as OT, Physio or Psychology. It also covers dietician and exercise physiology so it’s a good fall back if you run out of money in Health and Wellbeing or Improved Relationships.

I have never seen a plan with all 15 categories. Most of the time, plans have Core Supports plus two or three of the capacity building categories. The key thing to keep in mind is that plan managed funds can be used flexibly within the Core Supports categories, but that’s not the case for any other categories.

Funds can’t be moved from one capacity building category to another or used for supports that should be claimed under Core Support. For example, if you run out of money for personal care, you can’t use the funds from Improved Health and Wellbeing, no matter how much you’ve got sitting there. So that means you can exercise to your heart’s content but can’t afford to pay someone to help you to have a shower.

So for example, if you’ve spent more on doing stuff in the community than initially anticipated, we can amend the booking by moving some money from Assistance with Daily Life to Assistance with Social, Economic and Community Participation. However, this does mean that you will have less to spend on support at home. The bottom line is that you can’t spend more than what you get funded for.

The next lot of categories are called Capital Supports and it consists of:

5. Assistive Technology – used for purchase and maintenance of equipment

6. Home Modifications and Specialised Disability Accommodation (SDA) – this is mostly used to make your home more accessible. It also includes accommodation for people with high support needs.

The rest of the categories are called Capacity Building (CB) Supports. Why nine instead of one beats me.

They are:

7. Support Coordination – this allows a Support Coordinator to work with you to implement your plan and achieve your goals.

8. Improved Living Arrangements – this is funding specifically to help you to find somewhere appropriate to live or keep the place you’re living in.

9. Increased Social and Community Participation – this is about learning new skills to be more independent including having a mentor or using peer support.

10. Finding and Keeping a Job – this is specifically about employment. It can be used to get career counselling or get help from an employment agency. This is an important category to have for young people leaving school.

11. Improved Relationships – this is specifically about behaviour supports.

12. Improved Health and Wellbeing – this funds support from a dietician or exercise physiology.

13. Improved Learning – this is also for school leavers but it’s for help with transitioning to further education.

14. Improved Life Choices – it’s also called CB Choices & Control. This is the category to have if you would like any part of your plan to be plan-managed. It’s specifically for plan management.

15. Improved Daily Living Skills – it’s also called CB Daily Living or CB Daily Activity. This includes more supports than any other capacity building categories. This is my second favourite category after Core Supports. It covers early childhood intervention, skill development, nursing care and all the allied health supports such as OT, Physio or Psychology. It also covers dietician and exercise physiology so it’s a good fall back if you run out of money in Health and Wellbeing or Improved Relationships.

I have never seen a plan with all 15 categories. Most of the time, plans have Core Supports plus two or three of the capacity building categories. The key thing to keep in mind is that plan managed funds can be used flexibly within the Core Supports categories, but that’s not the case for any other categories.

Funds can’t be moved from one capacity building category to another or used for supports that should be claimed under Core Support. For example, if you run out of money for personal care, you can’t use the funds from Improved Health and Wellbeing, no matter how much you’ve got sitting there. So that means you can exercise to your heart’s content but can’t afford to pay someone to help you to have a shower.

If you are plan managed with futures in sight you receive a budget reports every month. Below an explanation of how to read and understand them. But first let's have a look at your NDIS my place portal

The Budget in our NDIA Portal

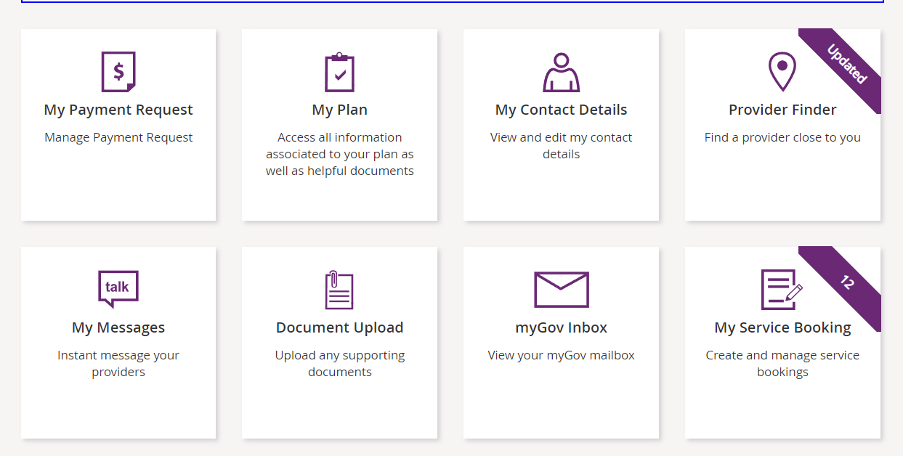

In order to access your NDIS portal, called Myplace, you have to create a MyGov account. If you don’t have that yet, here is a link to our website where we put together useful information and links on how to set up MyGov, Myplace, Centrelink and also Medicare.

|

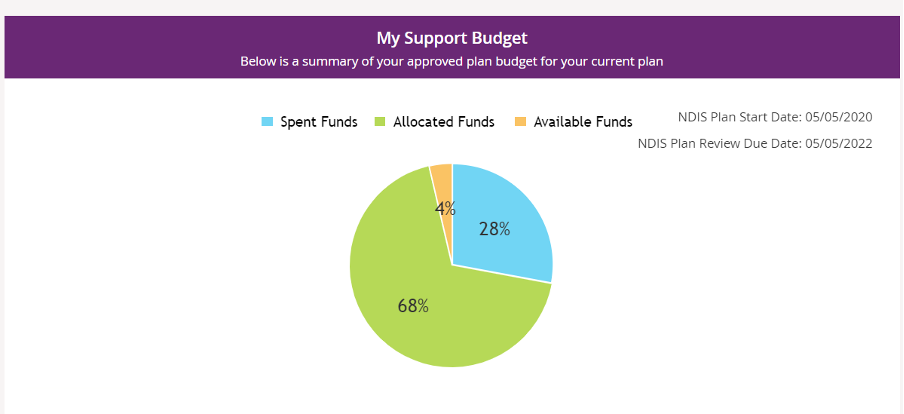

The first thing you see is a visual overview of your funding.

The headings are slightly confusing and worth explaining:

|

So, for people who are plan managed, such as in the example above, the pie looks very green to start with because the plan manager has booked the funds. Although the orange bit is called available funds, it doesn’t mean that that’s all you have available. The terminology has tripped up quite a few people. In this example, the person still has 72% (68% plus 4%) of their funding unspent.

|

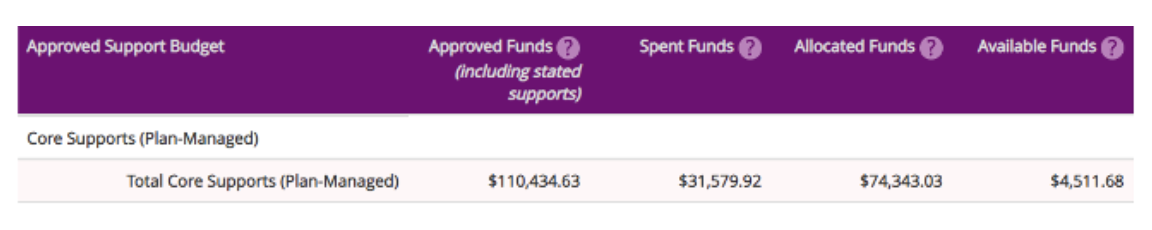

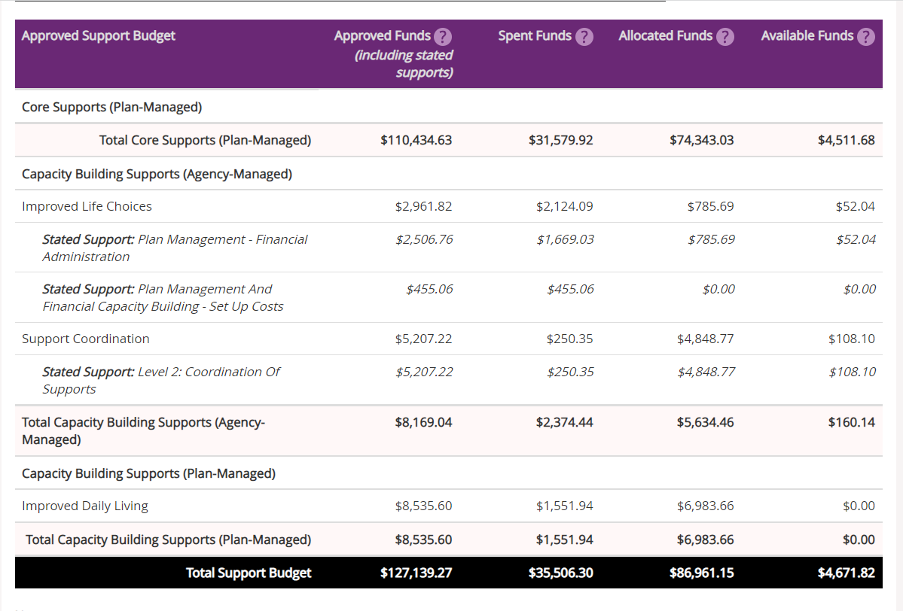

In addition to the pie chart there’s a more detailed table which sets out the dollar amounts in each category for what you start with (Approved Funds), how much you’ve spent to date (Spent Funds), unspent self-managed funds or funds booked by the plan manager or providers (Allocated Funds), and any unbooked funds (Available Funds). Here’s an example of what a detailed budget looks like.

|

The advantage this budget report has over the ones we send you (see below) is that it gives information about your entire plan regardless of how it’s managed. It also gives you the most up to date spending figures.

At times, the plan managed numbers in your NDIA budget might look slightly different to those in the reports you get from us. This is mainly because there’s a slight time lag for our system to update itself after each claim.

At times, the plan managed numbers in your NDIA budget might look slightly different to those in the reports you get from us. This is mainly because there’s a slight time lag for our system to update itself after each claim.

Reading and understanding your futures in sight Budget reports

On the 15th of every month, we send out two emails to people who we provide plan management services to. Each email contains a report, and together they help you to keep a track of your NDIS funding.

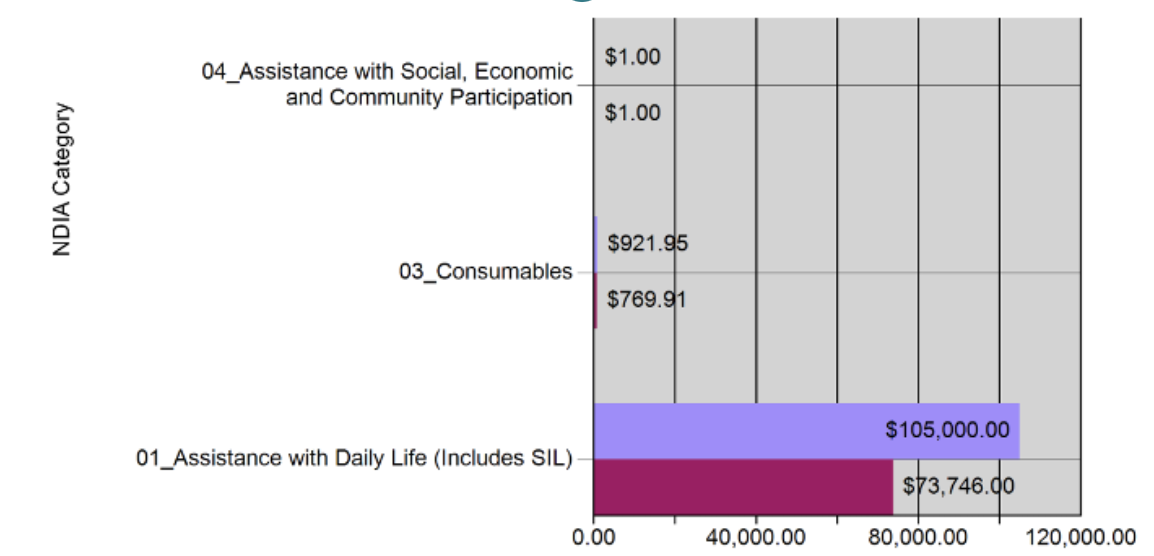

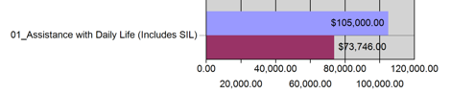

We suggest you look first at the Budget Spending report. That’s the one with a bar chart on the first page and it gives a quick visual overview of how you’re travelling with your funding.

We suggest you look first at the Budget Spending report. That’s the one with a bar chart on the first page and it gives a quick visual overview of how you’re travelling with your funding.

So, in the example here, the figure in the blue bar is how much the person has for Category 01 - Assistance with Daily Life at the start of their plan which is $105,000. They’re more than halfway through their plan but as the maroon bar shows, they still have more than half of the funding left. So, for this person, they’re travelling quite comfortably and there’s no need for any alarm bells yet! Maybe it’s time to think about introducing some more services

The second page of the report shows very much the same information in a slightly different format. The most important thing to look at here is that the dollars in the Remaining column are enough to support you until the end of your plan.

The second report is called Line Item Spending and it works a bit like a bank statement. It lists all the claims made in the previous month. So, for example, the report you received on the 15 October would contain all the line items claimed in September. Sometimes we get questions about why invoices from the previous month are not showing on the report. This is because they might not have been claimed in that month as the timing depends on when invoices are received and approved. So, it’s a good idea to keep all your monthly reports so you know when services and supports are claimed.

The other thing to notice about the Line Item Spending report is that it lists the claims by NDIS category. Which category you use and when can be quite important, particularly if you have tight budget. Some categories are more restrictive than others so using the appropriate category can help you to maximise your plan.

One thing to highlight about the reports is that the funding we report on is plan managed funding only. That means if you have funding that is either self-managed, (ie. transport money that is paid to you directly), or NDIA-managed, it won’t be included in these reports. This is why it’s so handy to be able to look up your NDIS portal.

The second report is called Line Item Spending and it works a bit like a bank statement. It lists all the claims made in the previous month. So, for example, the report you received on the 15 October would contain all the line items claimed in September. Sometimes we get questions about why invoices from the previous month are not showing on the report. This is because they might not have been claimed in that month as the timing depends on when invoices are received and approved. So, it’s a good idea to keep all your monthly reports so you know when services and supports are claimed.

The other thing to notice about the Line Item Spending report is that it lists the claims by NDIS category. Which category you use and when can be quite important, particularly if you have tight budget. Some categories are more restrictive than others so using the appropriate category can help you to maximise your plan.

One thing to highlight about the reports is that the funding we report on is plan managed funding only. That means if you have funding that is either self-managed, (ie. transport money that is paid to you directly), or NDIA-managed, it won’t be included in these reports. This is why it’s so handy to be able to look up your NDIS portal.